Tax Reporting

Centennial, CO

Over 14 Years of Experience

Walk-Ins Welcome

Locally, Family and Woman-Owned

Request Lorem Epsom

Hero Request Form

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later.

Tax Reporting

Centennial Gold and Silver

Tax Reporting Requirements for Bullion Transactions

The information provided herein is for educational purposes only and is not intended to serve as financial or tax advice. Please consult your tax professional for advice regarding your individual financial or tax situation.

There are two circumstances in which precious metals dealers are legally obligated to report consumer transactions to the IRS:

- When a consumer sells reportable quantities of specific bullion or coins; and

- When a consumer buys goods from a dealer and pays $10,000 or more in cash for the goods.

The former is a tax issue and will be discussed below. The latter is an anti-money laundering issue and is not the subject of this post. Contact us for personalized help with your tax reporting needs.

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

- Bullet text

Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.What items are IRS-reportable items?

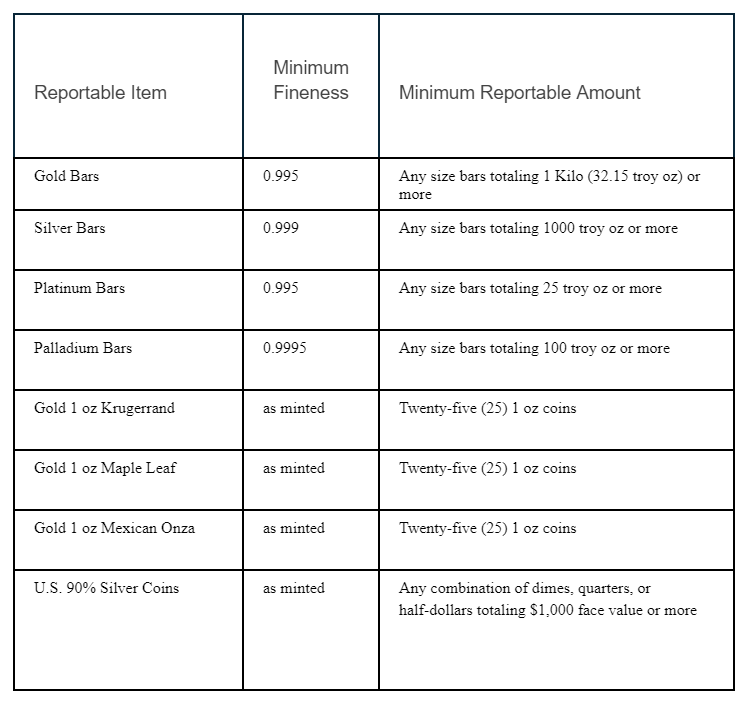

The IRS has specific rules regarding reportable transactions that require a Form 1099-B to be filed. These rules are detailed in the Form 1099-B instructions available on the IRS website. The following are guidelines provided by ICTA related to precious metal sales. Please note that both these guidelines and the IRS rules are subject to change at any time without notice.

Gallery Heading H2

| Reportable Item | Minimum Fineness | Minimum Reportable Amount |

|---|---|---|

| Gold Bars | 0.995 | Any size bars totaling 1 kilo (32.15 troy oz) or more |

| Silver Bars | 0.999 | Any size bars totaling 1,000 troy oz or more |

| Platinum Bars | 0.995 | Any size bars totaling 25 troy oz or more |

| Palladium Bars | 0.9995 | Any size bars totaling 100 troy oz or more |

| Gold 1 oz Krugerrand | As minted | Twenty-five (25) 1 oz coins |

| Gold 1 oz Maple Leaf | As minted | Twenty-five (25) 1 oz coins |

| Gold 1 oz Mexican Onza | As minted | Twenty-five (25) 1 oz coins |

| U.S. 90% Silver Coins | As minted | Any combination of dimes, quarters, or half-dollars totaling $1,000 face value or more |

Disclaimer: This table is provided for general informational purposes only and reflects commonly referenced IRS reporting thresholds for certain precious metal transactions. Reporting requirements may vary based on transaction type, payment method, or changes in federal regulations. Customers should consult a qualified tax professional or the IRS directly for guidance specific to their situation.